Traveling is EXPENSIVE! Almost everyone we meet asks us how we can live on one income and live on the road. Let me start off by saying that it isn’t always easy. From the outside looking in, I’m sure it looks much more glamorous than it really is sometimes. (Especially because the pictures and adventures that are the most fun to share are the ones that we splurge on.) But a monthly budget is an absolute must, especially when traveling.

I have always been big on budgeting. Before we went out on the road (the first time) we looked at what we spent each month and made a few simple decisions to help us better live within our means. Here are five different things we did that have done to cut our monthly budget down.:

One car, no payment.*

This one was a no brainer for us. Bryce worked from home and we were planning on being on the road with a trailer. One vehicle is all we needed. We still could share a vehicle while we were in Austin because I was pregnant/planning to stay at home and Bryce got to continue working remote. And now we are back on the road. This might not work for everyone, but this definitely cuts our monthly spending a great deal. We save on a second car payment, extra insurance costs, AND gas. Not to mention we get pretty decent gas milage in our Honda Odyssey minivan!

(*We had not had a car payment for the past few years thankfully. However, we are still making payments on the van. It will be paid off before the end of this year though which will help us to lower our monthly spending even more!)

No more Netflix or other unnecessary subscription services in our monthly budget.

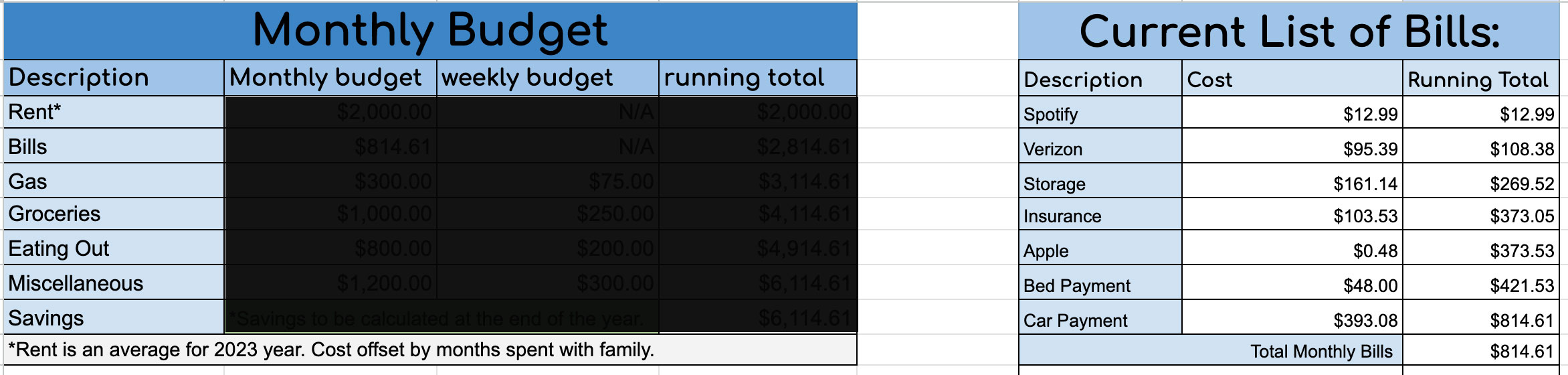

This was a little tougher for me. When we looked at how we could cut our budget down while we were on the road, we wanted to go as minimalist as possible. We said goodbye to Hulu, ESPN, Disney+, and Amazon prime. I also cancelled our wine subscription and Apple Music. The only exceptions were subscriptions for Spotify and Apple storage for our cell phones. Because we are on the road taking endless photos and spending countless hours driving we justified keeping those in our monthly budget.

Paperless statements, Autopay, and Auto-delivery when available (and convenient).

This “hack” may only save a few dollars here and there, but they add up! I was amazed at how much I could lower my monthly budget with this trick. Some services offer small discounts on your monthly bills by going paperless, or having an automatic payment/purchase each month. I set up paperless statements for my cell phone bill through Verizon and set up an automatic payment and save $10.00 each month.

I also set up an “automatic repeat delivery” with Petco. It saves me 5% on my repeat order as well as free shipping. Also, I am getting a larger bag with a lower cost per pound in general for buying in bulk. Which Petco also does not offer in their storefront locations. I also am saved from having to find a Petco (or other pet store close by) and make the trip to pick it up. To me it feels like a win, win win.

The only downside is that I have to make sure I update our address as we travel so that it doesn’t ship to an old address. It’s happened only once so far, and I definitely kicked myself for the loss. I have similar repeat orders set up with other things we use, too. And like I said before, you will be surprised at how big of a difference these small amounts can make!

More simplistic meals at home, eat out less.

Eating at home seems like an obvious solution to stop overspending, but it isn’t always an easy choice. Life can get SO busy. A day flies by and then by dinnertime cooking sounds miserable. Thankfully, I’ve got one of the best husbands in the world and he usually is our dinner chef. (He is also the health nut in our family, which really works out!)

Keep credit cards paid off.

As little income wasted on interest charges the better. Also, less frivolous purchases because there’s no room in our van. No extra stuff can be added without forethought. Keeps spending down on those random on a whim purchases and helps with any creeping credit card debt.

Not every budget cut can happen overnight. It took me a couple YEARS to get my credit card debt fully eliminated (and thankfully Bryce was more fiscally responsible than I was in college). In order to make a difference in your living costs, you have to plan your budget and then: STICK. TO. IT. What’s important is remaining disciplined and not letting yourself stretch your spending over what you have in your plan. Also, don’t let yourself get hung up on what you can’t do, but rather what you CAN. If you can’t get rid of your credit card debt right away, see what payment amount you need to begin to lower the balance and make sure that is your monthly payment.

This is not to say ‘never use your credit card until the balance is paid off’!!

Of course, your credit score is extremely important. So I would like to clarify that if you’ve got credit card debt, you do NOT have to stop using your credit cards until the balances are paid off in order to be successful in your budgeting. However, you will need to keep yourself accountable of your spending in the month and make sure that you are only spending what you can pay off each month (in addition to your payment that is lowering your overall balance).

Overall, You must live within your means, eliminate reoccurring debts, and make room for savings in your monthly budget if you want to eventually get out of the paycheck to paycheck rut.

Living out of a minivan surely helps us not buy too many frivolous things. (There isn’t a whole lot of extra room, so we have to figure out what we’re taking out of the car before we buy anything new.) While we know that we can’t stay on the road forever, living with as minimal monthly debts and eating at home helps us sustain our nomadic lifestyle (as well as staying with family along the way)!

SIDE NOTE:

I read a book when I got out of college that blew my mind and really got me thinking about the concept of the paycheck to paycheck “rat race” we all participate in. The book is “Rich Dad, Poor Dad” by Robert Kiyosaki. (That is a link to the book for sale on Amazon, but there is also the direct website you can visit here.) If this post interests you, I would HIGHLY recommend giving this book a shot. It is a really quick and easy read. Its been mentioned by Forbes, BBC, The Wall Street Journal, The New York Times and other major news sources, so I know the book has made an impact on more than just me!

If you know of another good book about budgeting, I would love to hear about it! Comment, or send me a message here!